SOL Price Prediction: Assessing the Bull and Bear Case for 2025

#SOL

- Technical Rebound Signals: MACD bullish crossover and Bollinger Band positioning suggest potential upward movement

- Ecosystem Crosscurrents: Phantom's expansion contrasts with Pump.fun's revenue collapse

- Catalyst Watch: Golden Cross formation and ETF approvals could drive next rally

SOL Price Prediction

SOL Technical Analysis: Key Indicators to Watch

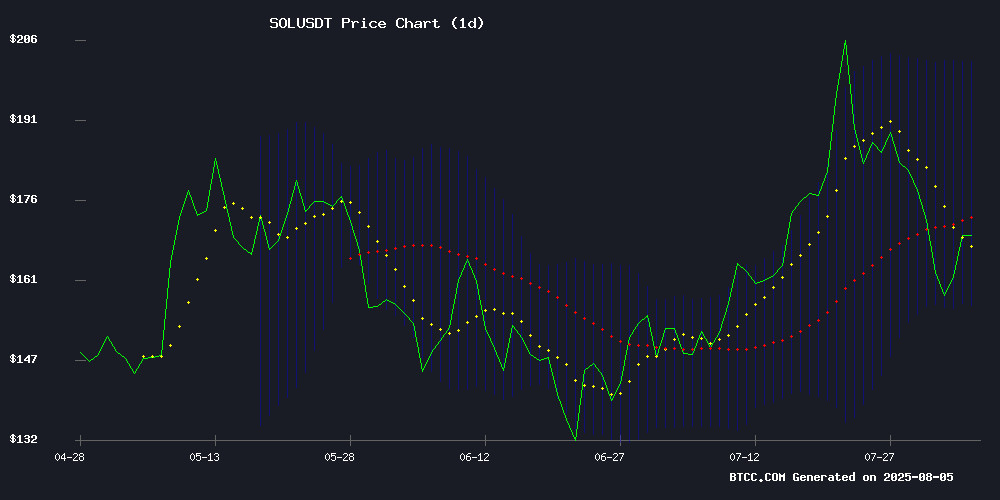

According to BTCC financial analyst Mia, SOL is currently trading at $167.72, below its 20-day moving average of $179.03, indicating potential short-term bearish pressure. However, the MACD shows a bullish crossover with a positive histogram (11.7707), suggesting possible upward momentum. Bollinger Bands reveal SOL is NEAR the lower band ($156.27), which could act as support. 'The technical setup hints at a possible rebound if SOL holds above $156,' Mia notes.

Mixed Sentiment for SOL as Ecosystem Developments Unfold

BTCC analyst Mia highlights conflicting signals in Solana's news flow. While Phantom's acquisition of Solsniper and DeFi Development Corp's $18M treasury expansion are bullish, Pump.fun's 80% revenue drop and SOL's 25% retreat from July peaks reflect bearish sentiment. 'The Golden Cross prediction and ETF approval potential could reignite rallies, but memecoin fatigue is a near-term headwind,' Mia states.

Factors Influencing SOL's Price

Pump.fun’s 80% Revenue Drop Signals Memecoin Market Slowdown

Pump.fun, a Solana-based memecoin platform, reported a steep 80% decline in July revenue, dropping to $24.96 million from January's peak of over $130 million. The slump reflects broader cooling in the memecoin sector, with total market capitalization falling 23.5% to $65 billion and trading volume down 67% from July highs.

DefiLlama data reveals a consistent downward trend, with February's $90 million revenue halving by March and plateauing near $40 million in subsequent months. Solana's token minting activity—a key indicator of memecoin demand—simultaneously hit a three-month low, underscoring fading retail speculation.

Solana Price Prediction: Golden Cross and Liquidation Squeeze Set Stage for Next Rally

Solana shows signs of a bullish reversal after bouncing off key support at $155. The token's technical structure suggests a confirmed bottom formation, with a breakout from a multi-month downtrend and an ascending support line pointing to potential targets up to $250.

Institutional adoption gains momentum as Artelo Biosciences becomes the first publicly traded biotech firm to integrate SOL into its financial reserves. The $9.475M treasury allocation signals growing corporate confidence in Solana's long-term value proposition.

Phantom Acquires Solana Trading Terminal Solsniper to Bolster Trading Capabilities

Phantom, the well-funded crypto wallet provider, has acquired Solsniper, a Solana-based trading and analytics platform. The deal terms remain undisclosed. Solsniper's web app will continue operating independently, while its team, led by CEO Max Zhuang, joins Phantom.

The acquisition signals Phantom's ambition to expand its trading offerings, particularly after its recent foray into perpetual futures trading via Hyperliquid. Solsniper specializes in advanced tools for memecoin traders, a sector that has proven highly lucrative on Solana.

Solana's memecoin frenzy has created significant revenue opportunities for analytics platforms. DEX Screener recently generated $2.9 million in monthly fees simply by charging projects to update token information. Other trading venues like Jupiter and pump.fun have already integrated similar terminal services.

DeFi Development Corp. Expands Solana Treasury with $18 Million Purchase

DeFi Development Corp., a publicly traded real estate software firm, has acquired an additional 110,000 SOL tokens worth approximately $18.4 million. This latest purchase elevates the company's total Solana holdings to 1.29 million SOL, valued at over $215 million at current prices.

The firm's Solana-per-share (SPS) metric has surged 47% to 0.0618 SPS in the past month, reflecting aggressive treasury growth. "Market conditions appeared favorable," said Dan Kang, Head of Investor Relations. "We're focused on growing SOL per share as quickly as possible."

Funding for the acquisition came from existing cash reserves and a $5 billion equity line of credit. Shares of DeFi Development Corp. rallied 10% on Monday, compounding year-to-date gains exceeding 2,100%.

Pump.fun Revenue Plummets 80% as Memecoin Fatigue Hits Solana Ecosystem

Pump.fun, the dominant platform for memecoin launches on Solana, has seen its monthly revenue collapse from $130 million in January to just $24.96 million in July 2025 - an 80% decline that signals waning retail interest in speculative crypto assets.

The platform's Total Value Locked remains elevated at $190.57 million, but this liquidity appears increasingly disconnected from actual trading activity. Meanwhile, LetsBonk has emerged as the new market leader as active traders abandon Pump.fun in droves, with participation dropping 62%.

This downturn reflects broader sector weakness, with the total memecoin market capitalization shrinking from $85 billion to $65 billion. The dramatic revenue contraction at what was once Solana's hottest launchpad suggests crypto's speculative frenzy may be entering a cooling-off period.

Solana (SOL) Retreats 25% From July Peak as Bearish Sentiment Takes Hold

Solana's SOL token has plunged 25% from its July high of $206, now hovering near $162 as profit-taking and weak market sentiment dominate. The Layer 1 blockchain asset faces critical tests at support levels of $160, $140–$136, and $120, with traders eyeing the $136–$148 range as a potential accumulation zone.

Analyst Autumn Riley notes institutional buying interest historically emerged in this price band, suggesting a possible inflection point for long-term investors. Resistance looms at $180–$185, requiring significant bullish catalysts to overcome.

The retreat erases gains from SOL's July rally, which peaked at $206 amid surging developer activity and institutional demand. Market capitalization now stands at approximately $90 billion as traders reassess positions.

Solana ETF Approval Could Fuel Fresh Price Rally in 2025

Solana is gaining renewed attention in the crypto market as it approaches a potential all-time high, driven by institutional ETF filings and significant whale accumulation. Analysts speculate whether SOL could surpass its previous peak of $293, fueled by bullish sentiment from Grayscale's GSOL and VanEck's VSOL proposals.

The ETF filings, structured as grantor trusts with unique fee models and staking mechanisms, signal growing institutional interest and regulatory clarity. This mirrors the trajectory of Bitcoin and Ethereum ETFs, which historically catalyzed market growth. Approval could unlock mainstream capital inflows for Solana, one of the fastest-growing layer-1 blockchains.

Whale activity underscores the optimism. Large holders are aggressively accumulating SOL, reinforcing confidence in its upward momentum. The convergence of institutional adoption and organic demand positions Solana for a potential breakout in 2025.

Solana Token Issuance Surges as Letsbonk Dominates Market

Solana's ecosystem is witnessing a significant uptick in token creation activity, with Letsbonk emerging as the clear leader. The platform accounted for 65.2% of all new tokens issued on Solana in the past 24 hours, outpacing competitors like pump.fun (23.1%) and BAGS (4.41%).

Letsbonk's dominance stems from its user-friendly interface, efficient onboarding process, and growing credibility within the Solana community. This trend mirrors Ethereum's early token issuance boom, suggesting Solana may be entering a similar phase of ecosystem maturation.

Solana's native token SOL has reflected this growth, gaining 12.73% over the past 90 days. The network's increasing developer activity and investor confidence point to sustained momentum in its decentralized finance infrastructure.

Full List of Solana ETFs Awaiting SEC Approval: Dates, Filings, and What’s Next

Asset management giants are racing to launch the first U.S. Solana ETFs, with VanEck, 21Shares, Bitwise, and Grayscale leading the charge. The filings signal growing institutional demand for regulated crypto exposure beyond Bitcoin and Ethereum.

Solana's position as a high-performance blockchain has made it a prime candidate for ETF products. Market observers note the applications mirror the early days of Bitcoin ETF approvals, with issuers testing regulatory boundaries.

VanEck's June 2024 filing marked the first formal attempt, followed closely by 21Shares' Cboe-listed proposal. Bitwise's November refiling and Grayscale's January 2025 conversion plan demonstrate the accelerating institutional interest.

Is SOL a good investment?

Based on current data, SOL presents a high-risk, high-reward opportunity:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | 6.7% below | Short-term oversold |

| MACD | Bullish crossover | Positive momentum |

| Bollinger Bands | Near lower band | Potential mean reversion |

| Ecosystem News | Mixed | Volatility likely |

Mia advises: 'Dollar-cost averaging could be prudent given the technical rebound potential against macro uncertainty.'

Memecoin market slowdown

ETF approval uncertainty

Liquidation risks